Should I be a Sole Trader or a Limited Company?

Posted on 6th December 2018 at 13:17

Which path should you choose? Of all the topics and information we’ve covered so far in this series, this might be one of the most difficult questions to answer.

Before getting started it should be noted that we would always recommend speaking to a professional advisor to ensure that you fully understand your available options and what each path could mean for you.

What’s the difference?

Sole traders: Taxed on their profits at income tax rates. These rates can rise up to a 45% tax rate on income over £150,000. Income tax is charged regardless of whether the profits are withdrawn or retained in the business.

Incorporated businesses: Taxed at corporation tax rates. As of April 2017 the rate of corporation tax is fixed at 19%. If the business chooses to retain profits within the business then these profits will not be subject to an additional tax charge.

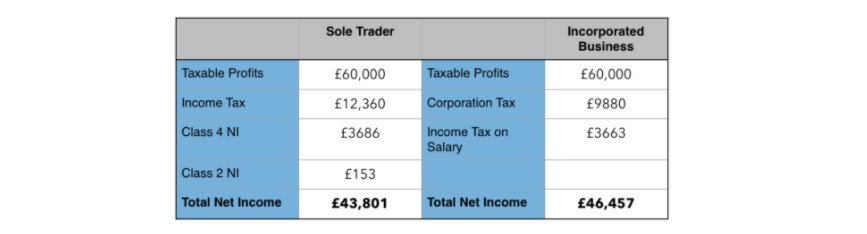

Let’s look at the following example:

This is obviously a very simple view of the possible figures as, for example, there would be tax to pay on any dividends taken from the limited company etc. Despite this fact it is clear to see that, from a tax point of view, there is a major benefit to running a successful and profitable business inside of a limited company structure.

So is the answer the same for everyone?

Unfortunately this is only looking into the situation from a tax point of view and doesn’t take into account the myriad reasons to consider before making your decision. You may also need to consider:

Additional professional costs of running a company.

Compliance with Company Law as a limited company.

Risks of unlimited liability as a sole trader compared to liability only up to the amount of share capital invested as a limited company.

Differing borrowing potential.

Simplicity of accounts for a sole trader against those of a limited company.

Ease of exit. Ceasing trading versus winding up a company.

Accountancy and legal fees involved, and many more.

The list can continue like this for some time. If you’re struggling to decide what is right for you then Moulds & Co Accountants are here to help.

How we can help

To understand what each option could mean for you then speak to a member of the Moulds & Co Accountants team today.

We understand that each situation is different and we aim to ensure that you make the most out of your finances. To speak to a member of the Moulds & Co Accountants team, call 01937 584188 or visit our offices in Wetherby and our professional tax and business advisors will be happy to provide the advice and information you need.

Help this post grow!

Share this post: